KYC Sanction Screen Solution to Detect Financial Crimes and Comply with AML / KYC Regulations

Onboard and monitor customers with greater accuracy and trust.

Our KYC Sanction Screening Solution helps organizations proactively mitigate risk and ensure compliance with a variety of AML, KYC, and counter-terrorist financing regulations.

The LegalEase Solutions Advantage

Meet Your KYC Regulatory Needs

- Automate beneficial owner due diligence and ongoing screening

- Capture and store information about each entity’s beneficial owners and directors and continually screen against our tech partners’ compliance watch lists

Automate Your Due Diligence

- Customize the ownership thresholds according to your risk appetite

- Integration with internal onboarding systems

Minimize Exposure to Risk

- Close gaps in data or documentation requirements by using advanced and accurate due diligence processes

- Validate customer or vendor submitted UBO info against the global UBO database

- Seamlessly screen the entity and its UBOs against watch lists at onboarding and ongoing

- Identify high-risk relationships more quickly & accurately, and de-risk accordingly

One Central Place for Documents, Reports & Audit Trail – Ready for Regulatory Scrutiny

- Beneficial ownership data is uploaded as part of client onboarding

- UBO certifications from customers or any document can be uploaded under the client profile for comparison to your due diligence results

- Complete audit history of the screening results including remediation efforts

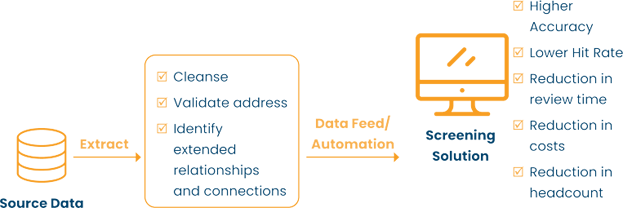

4 Step Process to Reducing Risk & Controlling Cost

- The name and address information of both customer and vendor records and the sanctions and PEP lists against which they are being matched are cleansed and standardized for consistent format comparisons

- Aliases, nicknames, and multiple names within a record are detected and included in the screening process

- Records are then accurately matched, despite anomalies including misspellings, transpositions, missing information, nicknames, acronyms, and initials

- Personnel time spent reviewing potential matches is minimized through the use of our tech partner's case management tool, which includes efficient workflows, audit trails, reporting, and management dashboards

These steps allow the proper balance between reducing risk and controlling cost.

Find out what LegalEase can do for your Compliance Department